does cash app report crypto to irs

Depending on network activity it can take. Click Statements on the top right-hand corner.

Does Cash App Report Your Personal Account To Irs

Nevertheless you would answer yes to the tax-form question.

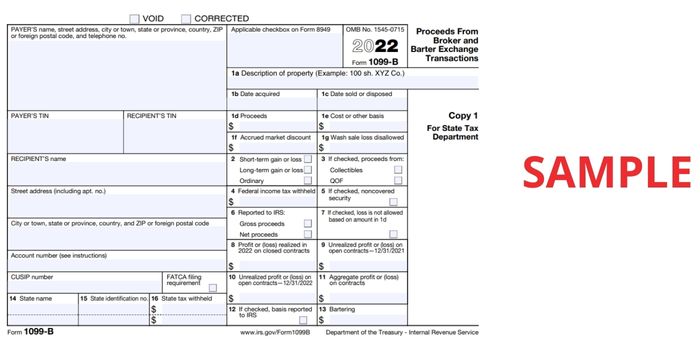

. In 2019 the IRS sent letters to more than 10000 taxpayers with crypto transactions who may have failed to report. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. Thanks all very insightful.

Which forms does Kraken use to report. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App.

Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. Kraken complies with all US IRS regulations. Once youve uploaded Koinly becomes the ultimate Cash App tax tool.

The answer is very simple. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send. If you are a user of this app and yours is a Business Account the app would normally need to report this information.

Even if no tax is due in year 2020 if a taxpayer answers no in 2020 based on the FAQ but then does not file a tax return for 2021 or files a tax return that omits a crypto. But if I make profit I should report that as taxable income. Coinbase will only report miscellaneous income to the IRS but not your overall gains or losses.

So if I sell used computer parts for LESS than I bought them I need not report it. The answer is very simple. It is your responsibility to determine any tax impact of your.

Bitcoin withdrawals and deposits must be enabled to get started. If you hold your bitcoin investment for a year or less before selling it you would have a short-term capital gain. Cash App does not provide tax advice.

Make sure you fill that. If you have sold Bitcoin. Koinly will calculate your Cash App taxes based on your location and generate your crypto tax report all.

The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form. What Does Cash App Report to the IRS. The IRS views Bitcoin as property instead of cash or currency.

Yes Coinbase does report your crypto activity to the IRS if you meet certain criteria. You can deposit up to 10000 worth of bitcoin in any 7-day period. Straight from the horses mouth here is what Kraken outlines on their FAQ page.

Tap the TRANSFER button on the apps home screen. Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app. You will have to fill out a form that contains all the.

However this doesnt mean that you dont need to report your capital gains or. The Infrastructure Investment and Jobs Act of 2021 IIJA was signed into law on Nov. Do I qualify for a Form 1099-B.

The IIJA includes IRS information reporting requirements that will require. Login to Cash App from a computer. Reporting Cash App Income.

Heres how you can report your Cash App taxes in minutes using CoinLedger.

Does Cash App Report Personal Accounts To Irs Get More Updates

Millions Of Us Business Owners Face New Rules As Venmo Paypal Zelle And Cash App Must Report 600 Transactions To Irs The Us Sun

Proposed 600 Bank Account Reporting Rule Won T Change Current Cash App Tracking Don T Mess With Taxes

Does Cash App Report To The Irs

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Cash App Taxes Review 2022 Formerly Credit Karma Tax

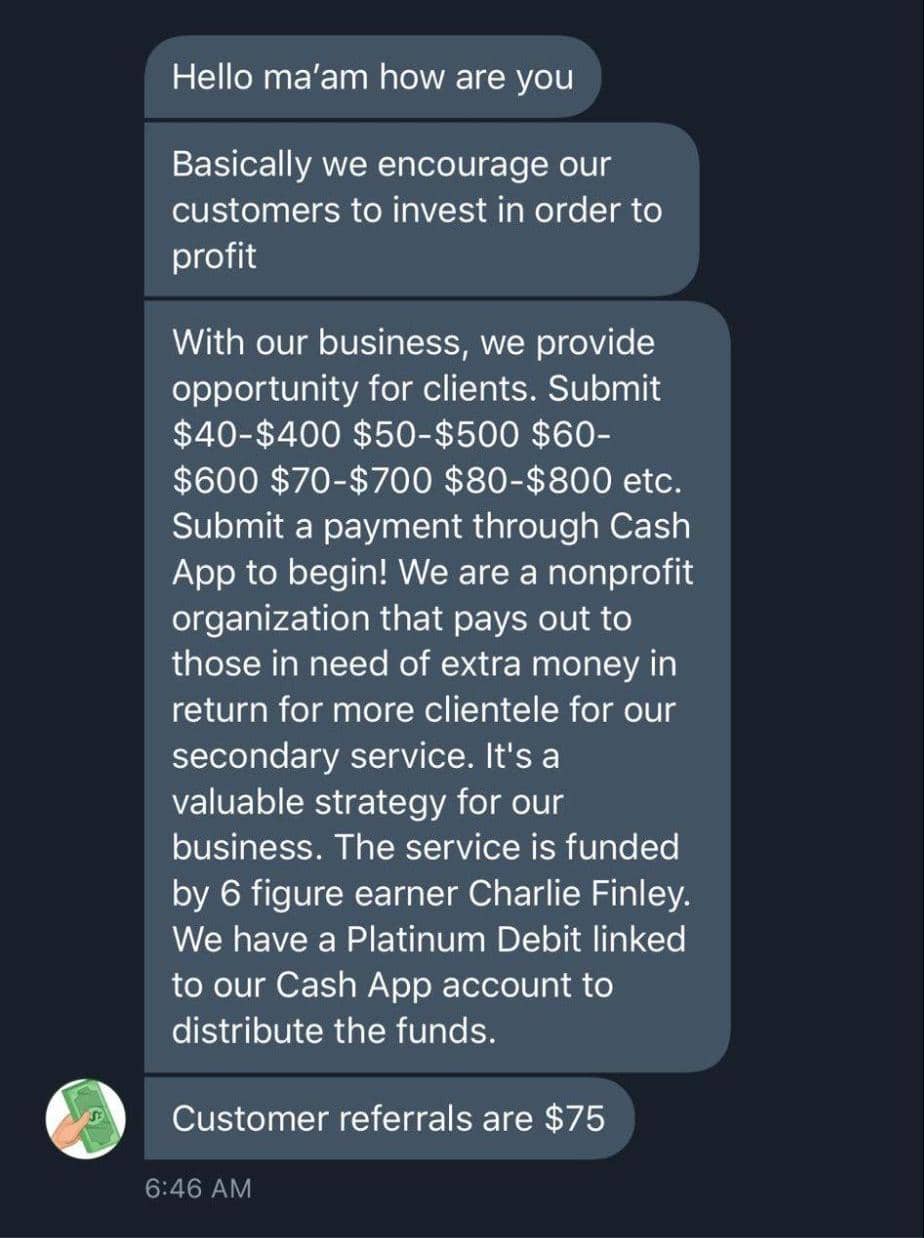

The 14 Cash App Scams You Didn T Know About Until Now Aura

How To Report 1099 Nec Or 1099 K Income Using Cash App Taxes

New Irs Rule Reduces Income Reporting From 20000 To 600 For Paypal Venmo Cashapp Zelle Others

Does Cash App Report To The Irs

Paypal Venmo Cash App Will Start Reporting 600 Transactions To The Irs

Does Cash App Report Personal Accounts To Irs 2022 Tax Rules

Does Cash App Report Your Personal Account To Irs

Cash App Taxes 2022 Tax Year 2021 Review Pcmag

Tax Reporting For Cash App For Business Accounts And Accounts With A Bitcoin Balance

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

Irs Crypto 1099 Form 1099 K Vs 1099 B Vs 1099 Misc Koinly

Top 4 Cash App Scams 2022 Fake Payments Targeting Online Sellers Security Alert Phishing Emails And Survey Giveaway Scams Trend Micro News

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor